ifo Business Climate Index Rises (April 2024)

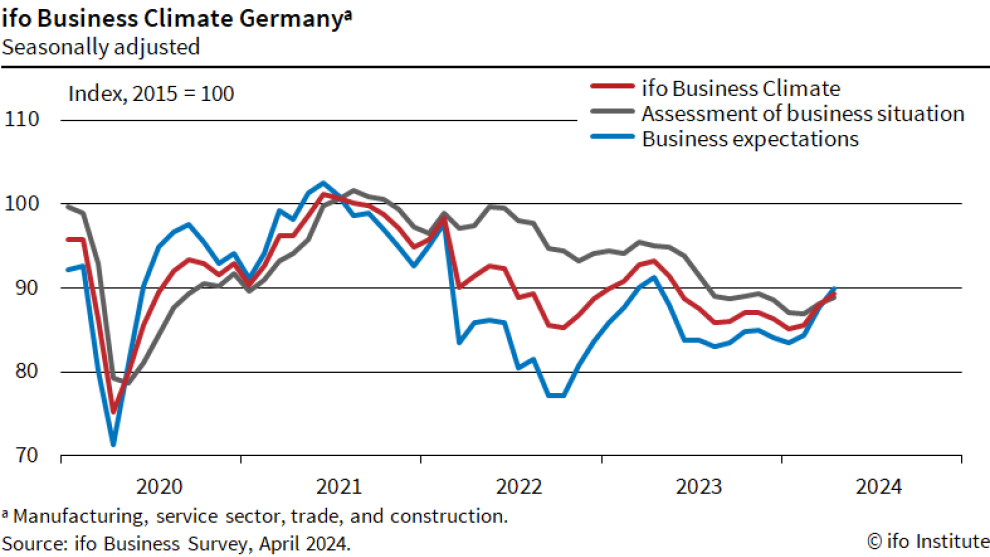

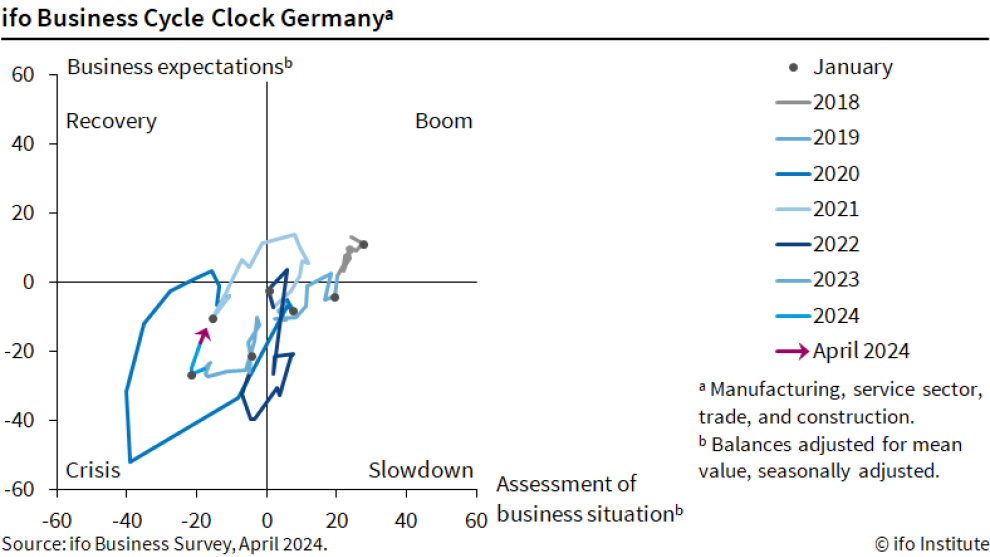

Sentiment has improved at companies in Germany. The ifo Business Climate Index rose to 89.4 points in April, up from 87.9 points1 in March. This is its third consecutive rise. Companies were more satisfied with their current business. Their expectations also brightened. The economy is stabilizing, especially thanks to service providers.

Download

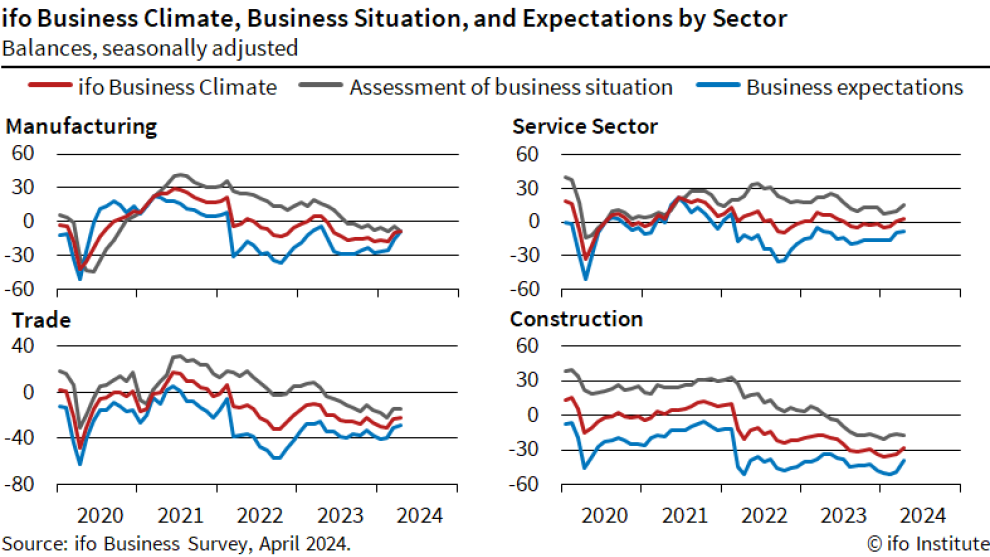

In manufacturing, the index rose. This was due to much less pessimistic expectations. However, companies assessed their current situation as worse. Order books shrank further. There is no prospect of increased production.

In the service sector, the business climate brightened noticeably. The improvement was particularly marked in the current situation. Expectations remained practically unchanged. Companies are still skeptical regarding the months ahead.

The index rose in trade as well. Business expectations improved markedly but remain pessimistic overall. Companies were somewhat less satisfied with their current business. This was driven primarily by the situation in wholesale; business improved sharply for retailers.

In construction, the business climate improved for the third time in a row. This was thanks to considerably less pessimistic expectations. Construction companies assessed their current situation as somewhat worse. Many companies reported a lack of orders.

Clemens Fuest

President of the ifo Institute

ifo Business Climate Germany

(Index, 2015 = 100, seasonally adjusted)

| 04/23 | 05/23 | 06/23 | 07/23 | 08/23 | 09/23 | 10/23 | 11/23 | 12/23 | 01/24 | 02/24 | 03/24 | 04/24 | |

| Climate | |||||||||||||

| Situation | |||||||||||||

| Expectations |

Source: ifo Business Survey.

© ifo Institute

ifo Business Climate Germany and by Sector

(Balances, seasonally adjusted)

| 04/23 | 05/23 | 06/23 | 07/23 | 08/23 | 09/23 | 10/23 | 11/23 | 12/23 | 01/24 | 02/24 | 03/24 | 04/24 | |

| Germany | |||||||||||||

| Manufacturing | |||||||||||||

| Service Sector | |||||||||||||

| Trade | |||||||||||||

| Construction |

Source: ifo Business Survey.

© ifo Institute