ifo Economic Forecast Spring 2020 Update: German Economic Output Collapses by 16% during Coronavirus Shutdown

During the coronavirus shutdown, economic output in Germany has collapsed by 16%. This is the result of an evaluation of April’s ifo surveys among some 8,800 companies across almost all industries. The estimate was based on the companies’ reported capacity utilization in January and in April as well as the actual and expected difference in sales in the first and second quarters..

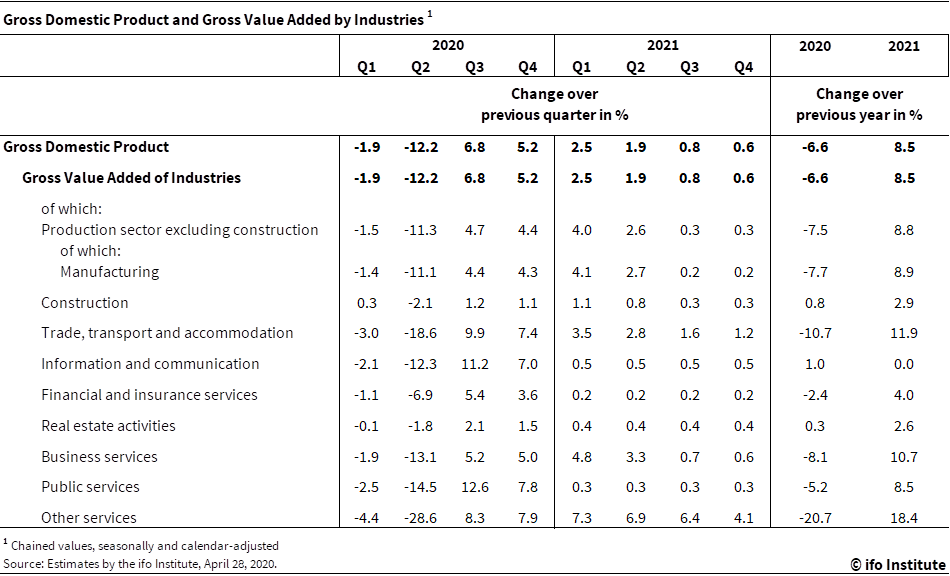

“This means that gross domestic product is likely to have fallen by 1.9% in the first quarter and can be expected to collapse by 12.2% in the second,” says Timo Wollmershaeuser, Head of Forecasts at ifo. Overall, economic output this year will likely shrink by 6.6% adjusted for calendar effects; taking into account the relatively high number of working days, the slump reduces to 6.2%.”

Wollmershaeuser adds: “We will not return to pre-coronavirus conditions until the end of 2021. Only then will production of goods and services attain the level it would have reached without the coronavirus crisis. To achieve this, GDP must grow by 8.5% in 2021.”

The biggest slumps in business in April were reported by travel agencies and tour operators (down 84%), aviation (down 76%), accommodation (down 68%), public health (down 45%), arts, entertainment, and recreation (down 43%), and vehicle construction (down 41%). The only winner in the coronavirus crisis was the pharmaceutical industry, where capacity utilization rose by 7%.

Once the shutdowns have ended, different sectors are likely to recover at very different rates, assuming that the restrictions in force since March are lifted only slowly as of the end of April. “It is primarily in the provision of leisure, entertainment, culture, accommodation, and restaurant services that the consequences of the coronavirus crisis will be felt well into next year,” Wollmershaeuser continues.

“In manufacturing, value added is likely to return to its pre-crisis level in a year’s time. Accordingly, we will see all economic sectors return to growth starting in the third quarter – but this growth will be on a significantly smaller scale than the decline in the first half of the year.”

All this is based on the assumption not that the coronavirus is defeated in the coming months, but that its spread can be contained and a second wave of infection avoided. It also assumes that neither Germany nor its sales and procurement markets experience a wave of insolvencies leading to distortions in the financial system and requiring a realignment of global value chains.

“We are currently experiencing the opposite of cyclical activity. There are no ups and downs and no persistent trend, but a crash at record speed and with an uncertain outcome.”

Den größten Einbruch der Geschäfte im April meldeten Reisebüros und Veranstalter (minus 84%), die Luftfahrtbranche (minus 76%), das Gastgewerbe (minus 68%), das Gesundheitswesen (minus 45%), Kunst, Unterhaltung und Erholung (minus 43%) sowie der Fahrzeugbau (minus 41%). Einziger Gewinner der Coronakrise war die Pharmaindustrie mit einem Anstieg der Auslastung um 7%.

Nach Ende der Schließungen dürften sich die einzelnen Branchen in sehr unterschiedlichem Tempo erholen, unter der Annahme, dass die seit März geltenden Beschränkungen nur langsam ab Ende April aufgehoben werden. „Vor allem dort, wo Dienstleistungen für Freizeit, Unterhaltung, Kultur, Beherbergung und Gaststätten erbracht werden, werden die Folgen der Coronakrise bis weit ins nächste Jahr hinein zu spüren sein“, sagt Wollmershäuser weiter.

„Im Verarbeitenden Gewerbe dürfte die Wertschöpfung ihr Vorkrisenniveau in einem Jahr wieder erreichen. Entsprechend werden ab dem dritten Vierteljahr alle Wirtschaftszweige zwar wieder Zuwächse verbuchen können. Diese werden aber deutlich geringer ausfallen als der Rückgang in der ersten Jahreshälfte.“

Bei alledem ist unterstellt, dass das Coronavirus in den kommenden Monaten zwar nicht besiegt, seine Ausbreitung aber eingedämmt und eine zweite Infektionswelle vermieden werden kann. Auch wird angenommen, dass es zu keiner Insolvenzwelle kommt, weder in Deutschland noch in seinen Absatz- und Beschaffungsmärkten, die zu Verwerfungen im Finanzsystem führt und die eine Neuausrichtung globaler Wertschöpfungsketten erfordert.