Eliminating the Middle-class Bulge – Income Tax Reform Options and their Fiscal Costs

ifo Institut, München, 2017

ifo Schnelldienst, 2017, 70, Nr. 09, 31-38

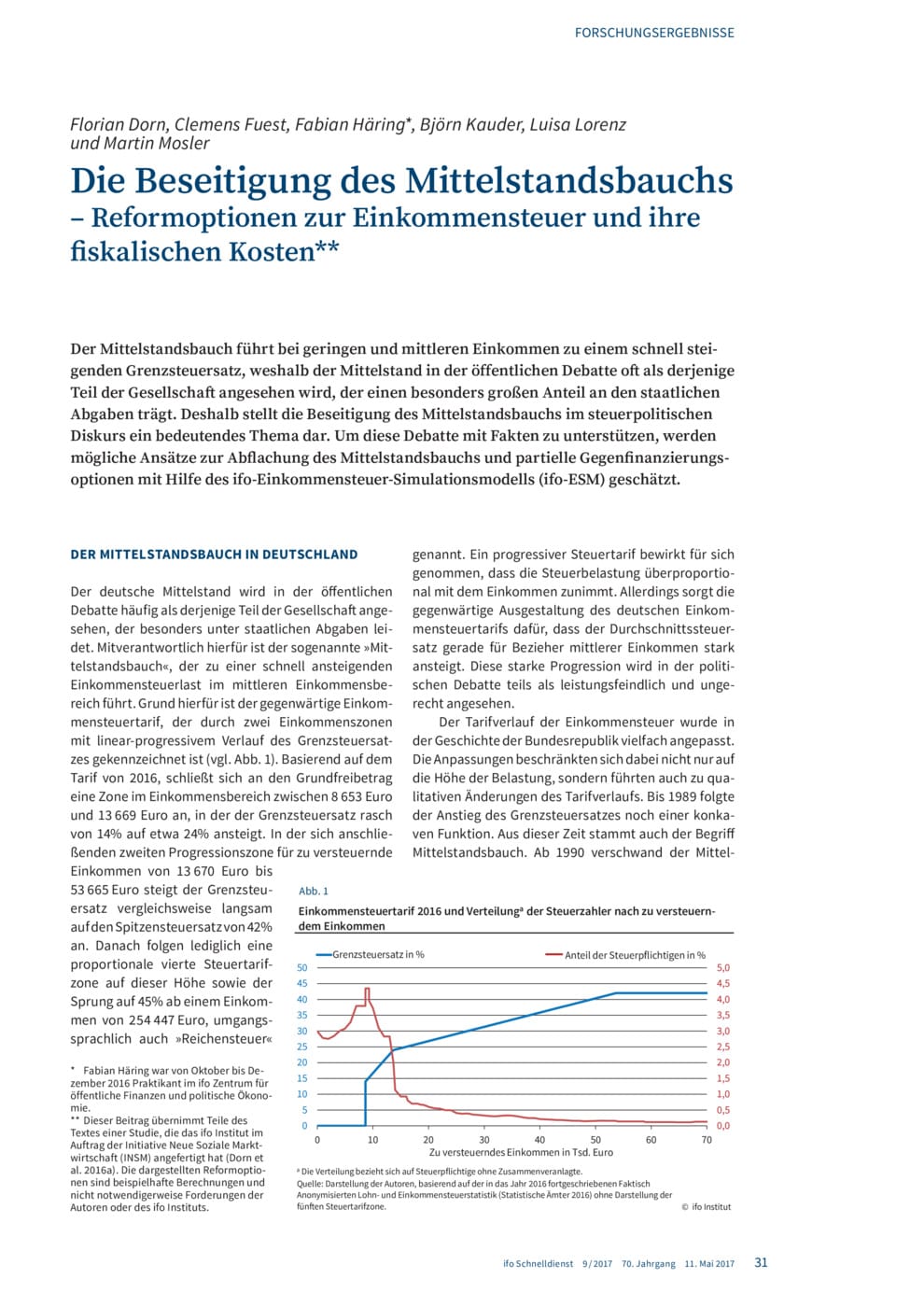

Taxpayers with small and medium-sized incomes experience a rapidly rising marginal tax rate, which is why the elimination of the middle-class bulge is an important issue in fiscal policy. To provide facts for this debate, the Ifo Institute has estimated possible approaches to flattening this bulge and some options for its financing using the ifo income tax simulation model (ifo-ESM) and indentifying what burden and relief effects would result for the public budgets. The reform scenarios presented do not create a worse situation for the taxpayer compared to the status quo. All income-tax payers who are above the basic tax-free level benefit from a flattening of the middle-class bulge. Conversely, however, this also means less tax revenue for the state of the same amount. The “correct” distribution of the tax burden among different groups of income earners cannot be made by public-finance economists; it remains a question that must ultimately be decided by means of democratic-political discourse.