Ifo Economic Forecast 2012/2013: Increased Uncertainty Continues to Curb German Economy

ifo Institut, München, 2012

ifo Schnelldienst, 2012, 65, Nr. 13, 15-68

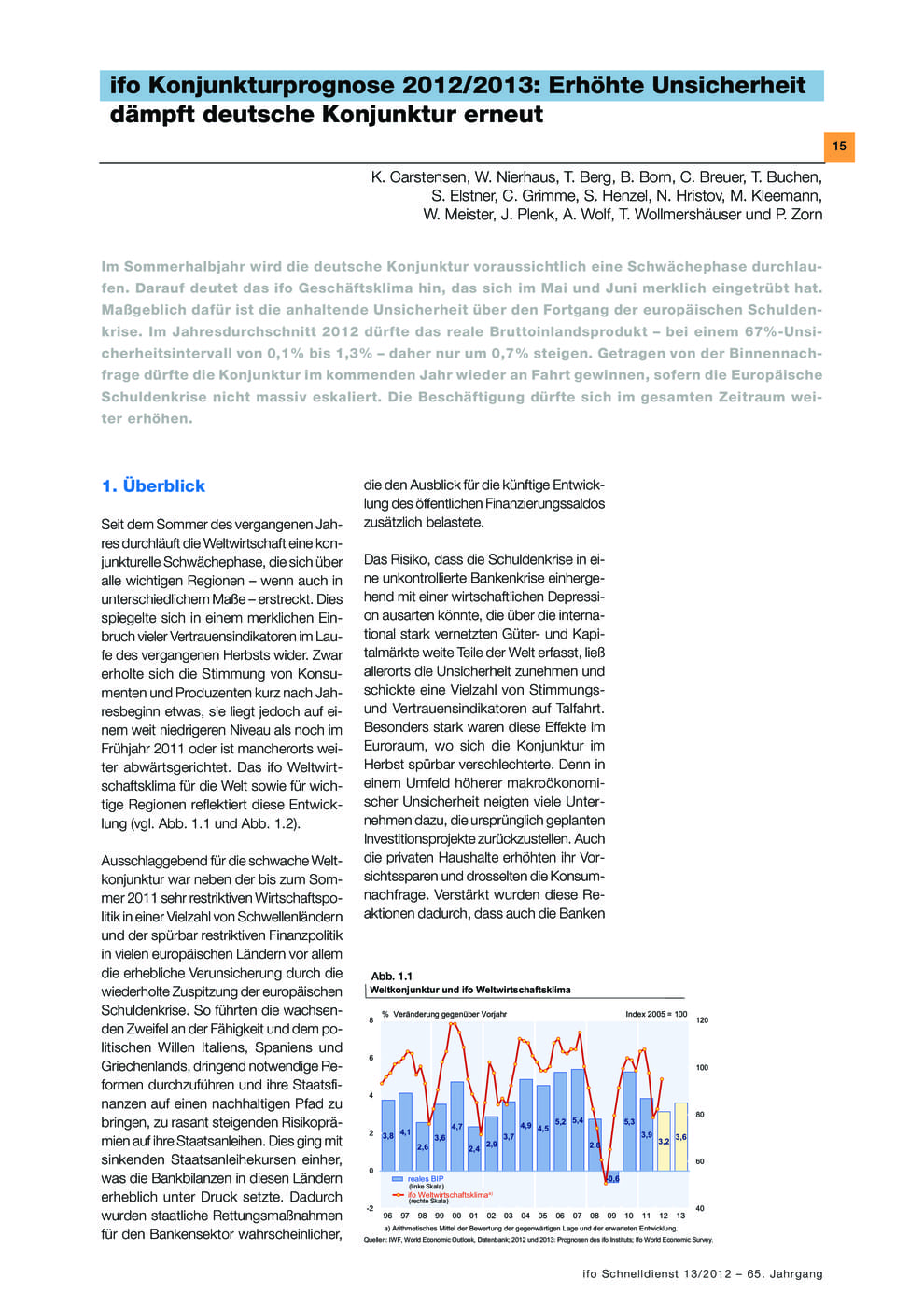

The German economy is expected to experience a weak phase in the second half of 2012. This is prefigured by the Ifo Business Climate, which deteriorated noticeably in May and June due to prolonged uncertainty regarding the development of the European debt crisis. Real gross domestic product - at a 67% uncertainty interval of 0.1% to 1.3% - should therefore only increase by 0.7% on annual average in 2012. Boosted by domestic demand, the economy should regain momentum next year as long as the European debt crisis does not escalate massively. Overall, real gross domestic product should increase by 1.3% in 2013. Against this background, employment should continue to rise; and in 2013 it is expected to reach 610,000 persons above the level of 2011. Due to the increasing labour supply generated by migration from the EU and the "hidden reserve", however, the number of unemployed will not drop to the same extent. Unemployment is expected to drop by 110,000 persons this year and by 50,000 in 2013, when the unemployment rate should be 6.6%. Inflation looks set to remain strong. Although no major fresh upward pressure on prices is expected from crude oil prices, domestic pressure looks set to increase. Overall, consumer prices are expected to increase by 2% in 2012 and 2013 respectively. Adjusted for the influence of fuel prices, inflation should rise from 1.6% in 2012 to 2.2% in 2013. The total budget deficit should be reduced to 0.3% of nominal gross domestic product this year, and Germany should even be able to balance its budget next year. The uncertainty surrounding forecasts is very high at the moment. More specifically, the economy depends far more heavily on political decisions than usual, which are difficult to predict.